Emma Broming and Rebecca Upton will be presenting PQC, Inc.’s research on Women Entrpereneurs’ Social Networks at the upcoming annual meeting of the Midwest Sociological Society. Ms. Broming and Dr. Upton will be presenting “Women Entrepreneurs and Social Networks: Promises and Pitfalls in the Work/Family Balance” on Saturday, April 1st in Milwaukee. More information about the MSS Annual Meeting is available here.

Category Archives: Public Policy

What do Women Business Owners Say About Corporate Supplier Diversity Programs?

We recently published Part 1 of our research into women business owner’s participation in corporate supplier diversity programs (see previous post). In this post, we highlight some of the key conclusions of our initial (and ongoing) research, using the results of the NWBC-sponsored survey:

- The most in-demand program offering was “introductions,” with approximately 75 percent of respondents indicating that they are “likely” to participate in that component of a program. This emphasizes that the entrepreneurial social network is a key component in starting and growing businesses, particularly in regards to securing contracts with large corporations.

- The number one impediment faced was the lack of contacts with decision-makers, closely followed by the lack of relationships with actual buyers. The quantitative results are confirmed by the focus group transcripts: women felt that accessing an individual who could actually execute a contract and hire them was a major impediment and barrier yet to be removed.

- Respondents were less interested in participating in mentorship and training than they were in meeting decision-makers. Approximately 25 percent of individuals surveyed indicated that they were not likely to participate in a mentorship and training program. Respondents noted that actually interacting with the buyers was an essential step to demonstrating capability and securing a contract.

- Women did not feel that they lacked capacity to meet the demand of large corporations. In fact, only 12.5 percent of respondents selected this choice. Women felt more hampered by the complexity and bureaucracy of the contracting process, as over 48 percent of survey respondents selected this barrier.

- A major finding of this work is that the barriers faced by women entrepreneurs in supplying large corporations do not vary greatly by revenue. This indicates that the gap in women’s participation as corporate suppliers is not entirely a function of capacity; rather other factors including politics and social networking are at play.

For the full report, click here!

Research on Women’s Participation in Corporate Supplier Diversity Programs, Part 1

The National Women’s Business Council (NWBC) recently released part 1 of our investigation into women’s participation in corporate supplier diversity program. As part of this initial research effort, PQC’s Emma Broming directed the quantitative analysis of an NWBC-sponsored survey that obtained feedback on women business owners interaction with, and use of, corporate supplier diversity programs.

As noted by PQC and echoed by the NWBC, corporate supplier diversity programs are a “win-win” for customers and suppliers as they positively affect the marketplace by increasing the number of qualified and experienced members of the supply chain. For women-owned firms, corporate supplier diversity programs can serve as a critical pathway to corporate market access as contracting with large corporations is an opportunity for women business owners to develop stable revenue streams, enhance their social networks, and scale up their businesses. Private and public corporations initiate supplier diversity programs to incorporate women- and minority-owned businesses into their procurement processes across the supply chain. The stability and connections developed within high quality programs may advance growth-oriented and scale-up women business owners in intensifying and expanding their businesses.

The complete report is currently available on the NWBC website!

Attend the Upcoming WBENC Conference in Orlando!

A quick plug for one of the best conferences each year – the annual WBENC National Conference & Business Fair, held in our very-own hometown of Orlando, Florida! The conference will be held June 21-23 this year, with details and registration information available here.

Minority-Owned Firms and Federal Procurement – What Do the Dollars Show?

We recently took a look at minority-owned firms and federal procurement contracting data for fiscal years 2012 through 2014 as part of our ongoing research into federal procurement activity by women- and minority-owned firms. In this blog post, we present some initial data with respect to minority-owned firms, focusing on overall and industry-specific contracting trends.

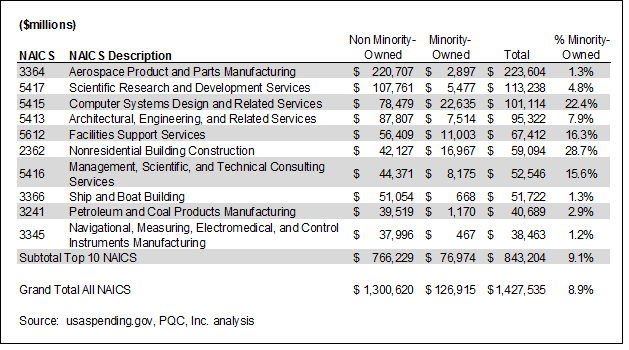

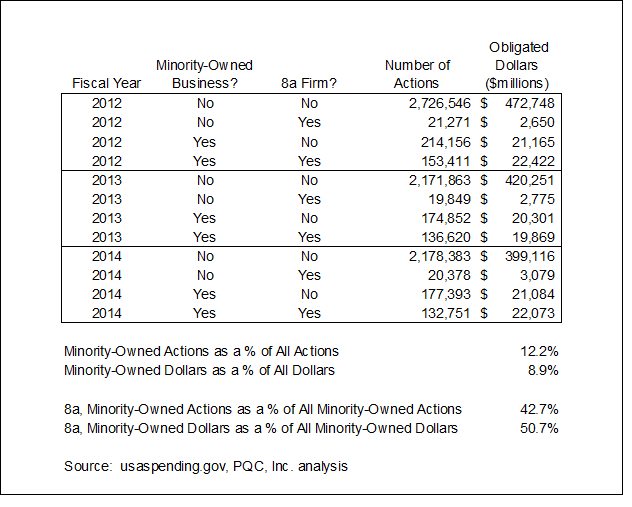

In examining federal procurement activity for minority-owned firms, we analyzed federal procurement data[1] for three fiscal years (2012 through 2014) and tabulated data based on several key identifiers, including fiscal year, DUNS number, obligated dollar amount, NAICS code[2], and flags for minority-owned business status and 8(a) status. Table 1 summarizes aggregate procurement activity by fiscal year, minority-owned status[3], 8(a) status, the number of actions and dollars obligated. The data indicate that during the relevant time period, minority-owned businesses accounted for 8.9 percent of the total dollars obligated.[4] In addition, approximately 51 percent of the dollars obligated to minority-owned firms were attributable to 8(a) firms.

Table 1

Diving deeper on an industry-level basis, we found significant variation in minority-owned firm activity based on particular NAICS codes. We first investigated the ten NAICS codes that accounted for the most dollars obligated in FY2012 through FY2014. Table 2 presents these data.

Diving deeper on an industry-level basis, we found significant variation in minority-owned firm activity based on particular NAICS codes. We first investigated the ten NAICS codes that accounted for the most dollars obligated in FY2012 through FY2014. Table 2 presents these data.

Table 2

Large differences existed in the level of minority-owned firm participation between different NAICS codes. For example, minority-owned firms accounted for 28.7 percent of total dollars obligated in NAICS 2362 – Nonresidential Building Construction, yet accounted for only 4.8 percent of total dollars obligated in NAICS 5417 – Scientific Research and Development Services. There are a number of reasons which might explain these observed differences, including both the number of minority-owned firms operating within a particular NAICS code, the size of particular awards in an NAICS code, the contracting mechanism (i.e., obligated dollars could be associated with a larger procurement instrument) and a host of potential economic and procurement issues that influence whether a particular firm engaged in federal procurement within an industry. Indeed, disparity studies are often a cornerstone of evaluating existing policies and programs designed to facilitate contracting activity among underrepresented groups.

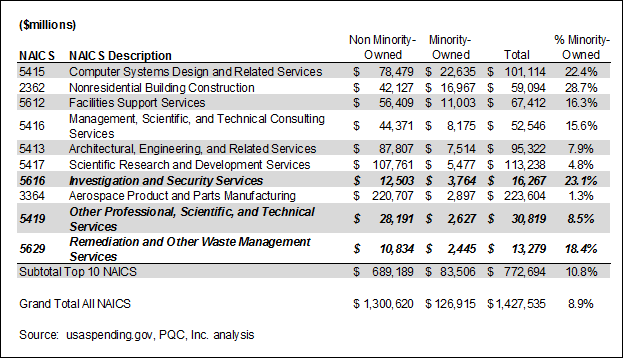

We expand the analysis to focus on the NAICS codes with the largest dollar amount obligated to minority-owned firms. Table 3 summarizes these data, which have significant overlap with Table 2. Exceptions are noted in bold and italics, representing NAICS codes in Table 3 that do not appear in Table 2.

Table 3

The data indicate that for 7 of the top 10 NAICS codes for minority-owned firms, the utilization (as measured in percent of total dollars awarded to minority-owned businesses) exceeds the overall minority-owned business average of 8.9 percent. Exceptions include NAICS 3364 – Aerospace Product and Parts Manufacturing (which is dominated by several large conglomerates), as well as NAICS 5413 – Architectural, Engineering and Related Services (at 7.9 percent) and the aforementioned NAICS 5417 (at 4.8 percent).

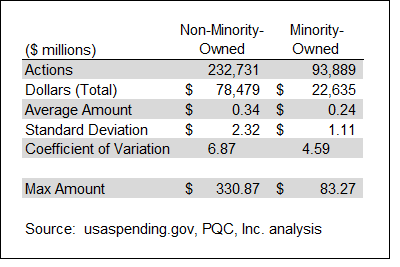

As part of our investigation, we examined the largest NAICS code for minority-owned activity based on dollars (NAICS 5415 – Computer Systems Design and Related Services). Table 4 presents a comparison of key metrics between minority- and non-minority-owned firms in this NAICS code. Interestingly, the average dollar amount per contract action is significantly lower for minority-owned firms ($240,000 versus $340,000), although the coefficient of variation is also lower.[5] One reason for this observation is the presence of several large contract actions. Notably, the maximum amount for a non-minority-owned firm is approximately $331 million, which is almost four times greater than the maximum contract action for a minority-owned firm.

Table 4

In future blog posts, we will continue to share insights into federal procurement activities for minority- and women-owned firms. As always, if you need any assistance with market research regarding contracting activity, disparity study analysis, or federal procurement assistance, do not hesitate to reach out and contact us!

In future blog posts, we will continue to share insights into federal procurement activities for minority- and women-owned firms. As always, if you need any assistance with market research regarding contracting activity, disparity study analysis, or federal procurement assistance, do not hesitate to reach out and contact us!

[1] We used data from usaspending.gov, which captures data from the Federal Procurement Data System – Next Generation (FPDS-NG).

[2] NAICS refers to the North American Industrial Classification System, which categorizes industry-level activity into a series of 6 digit NAICS codes. Primary NAICS categories are captured at the initial 2 digits, with each successive digit providing a greater level of detail and less aggregation.

[3] This flag indicates whether a firm “self-reports” as a minority-owned firm.

[4] To place the 8.9 percent value in context, recent Census data indicate that as of 2012, there were approximately 8.0 million minority-owned firms, up from 5.8 million in 2007. The Census data also indicate the 8.0 million minority-owned firms represent 29 percent of all firms with or without paid employees in 2012. See http://factfinder.census.gov/faces/tableservices/jsf/pages/productview.xhtml?src=bkmk.

[5] The coefficient of variation is the standard deviation divided by the mean. It is a measure of dispersion in a particular distribution. A higher coefficient of variation indicates a higher variation.