A rapidly changing global business environment continues to lead to heightened awareness of intellectual property matters among business executives, academics and government officials. Multinational taxation, capital budgeting, mergers and acquisitions (including spin-offs), patent litigation, licensing agreements, and brand names and trademark issues represent just a few of the intellectual property issues many businesses face on a daily business. One question we are asked over and over again, is “do we value intangible assets and intellectual property?” Our answer depends on the nature of the intangible assets and the purpose of the valuation.

The goal of this blog entry is to provide an introduction to intangible assets which will allow readers to fully understand how the appropriate valuation of intangible assets is essential to a number of intellectual property matters. In part 1, we cover intangible asset definition before considering valuation issues in a subsequent post.

What Are Intangible Assets?

Although a seemingly straightforward question, we immediately see that intangible asset valuation can often be a subjective and complicated issue. The answer to our question depends largely on whom you ask. Different valuation experts and valuation organizations have varying definitions, often depending on the specific purpose and function of the intangible asset under consideration.

For the purpose of this discussion, one of the best definitions of intangible assets can be found in Robert Reilly and Robert Schweihs’ book, Valuing Intangible Assets. The authors define intangible assets in a narrow sense, applying a set of strict criteria, including that an intangible asset has the following attributes:

• Not physical in nature

• Specific identification and recognizable description

• Legal existence and legal protection

• Subject to private ownership and transferability

• Tangible evidence or manifestation of the intangible asset

• An identifiable “birth date”

• Subject to termination

It should be noted that all of these points, except for the first one, are applicable to tangible assets as well as intangible assets. It is important to remember the distinction between that which is tangible, e.g., physical in nature and touch, and that which is intangible. Generally, intangible assets fall into a variety of categories, with some common ones listed below including an example of each.

• Marketing (brand names and trademarks)

• Technology (patents, processes, schematics)

• Artistic (musical compositions)

• Customer (customer lists)

• Contract (license agreement)

• Human Capital (workforce-in-place)

• Location (leasehold interest)

• Goodwill and Going Concern

Clearly there is some commonality among these categories. They are not meant to be exclusive, but rather an indication of the wide variety of intangible assets present in today’s business environment. Furthermore, intangible assets are not a new occurrence, as many of the above categories (and intangible assets) have been around for a long time. What has changed is the value that is placed on intangible assets, thereby creating a wide variety of reasons to try and place a value on them. Understanding the reason for the intangible asset valuation, whether for tax purposes, corporate planning, or dispute resolution, is paramount when considering the nature of the intangible asset under investigation.

Intellectual property, on the other hand, is often considered a subset of intangible assets — those that are “creations of the mind” and include artistic materials, patents, trademarks, etc. Intellectual property is most often considered in the context of litigation, or the field of intellectual property law. However, the boundaries of the intellectual property definition have migrated to include the innovative processes that create valuable intangible assets.

Why Do We Value Intangible Assets?

The reasons for valuing intangible assets and intellectual property are as diverse as the intangible assets themselves. In this section, we briefly touch upon several of the more common reasons for valuing intellectual property.

Tax Purposes

Multinational companies face a wide variety of challenging tax issues involving intellectual property. One example involves the licensing of intellectual property between domestic and foreign entities. Under Section 482 of the Internal Revenue Code, the appropriate transfer prices are subject to review by the Internal Revenue Service. Companies are required to justify intercompany transfer prices concerning the licensing and use of intellectual property by various foreign and domestic entities. A second example involves cost sharing agreements (CSAs). CSAs are one area where the IRS focuses a considerable amount of attention. A cost sharing agreement represents an agreement between two or more parties to share the costs to develop one or more intangibles in proportion to reasonably anticipated benefits from the individual exploitation of interests in the intangibles that are developed. Multinational companies may use CSAs to shift profit to low tax jurisdictions, resulting in lower taxes and higher earnings.

Patent Litigation

One of the most important intellectual property matters facing creative and innovative companies is the protection of valuable patents. Patent infringement is often a complex issue which requires a diligent review of the value of the patent and related intellectual property. In litigation proceedings, companies and attorneys look to valuation experts to appropriately value the intellectual property and patents which might have been infringed upon. Combining valuation practice with economic damage analysis will assist the courts in assessing the potential liability in patent infringement cases. The starting point is an assessment of the value of the intellectual property.

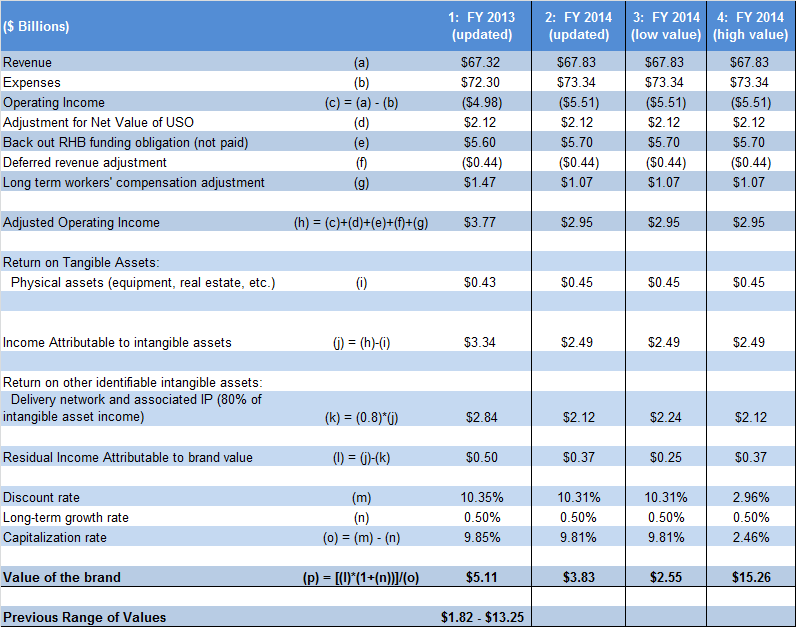

Brand Name and Trademark Valuation

Another equally important valuation issue facing business managers is the appropriate determination of the value of brand names and trademarks. One example involves the licensing of trademark use by third-parties. Companies need to recognize that the value of the trademark will dictate the appropriate compensation for use and disposition of the trademark by third parties. In a global business environment, which includes brand names and trademarks valued in the billions of dollars, understanding the true value of a company’s trademarks and brand names is essential for protecting brand equity and recognition.

Mergers and Acquisitions

When a company elects to divest a business segment with valuable intangible assets, the sale price will depend on an accurate valuation of assets, including intellectual property. At the heart of this issue is the perceived future economic benefit a willing buyer might receive through the acquisition and use of the intellectual property. As a result, valuation experts must employ sound valuation theory in assessing the true value of the intangible assets and intellectual property.

In our next post, we explore some of the valuation issues and methods related to intangible assets and intellectual property.

Do you need intangible asset or intellectual property valuation assistance? For more information, contact us.