We recently took a look at minority-owned firms and federal procurement contracting data for fiscal years 2012 through 2014 as part of our ongoing research into federal procurement activity by women- and minority-owned firms. In this blog post, we present some initial data with respect to minority-owned firms, focusing on overall and industry-specific contracting trends.

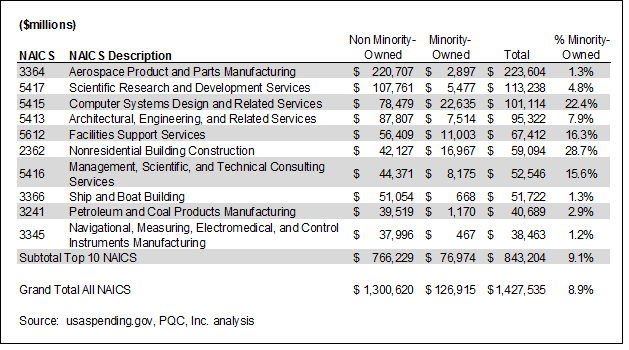

In examining federal procurement activity for minority-owned firms, we analyzed federal procurement data[1] for three fiscal years (2012 through 2014) and tabulated data based on several key identifiers, including fiscal year, DUNS number, obligated dollar amount, NAICS code[2], and flags for minority-owned business status and 8(a) status. Table 1 summarizes aggregate procurement activity by fiscal year, minority-owned status[3], 8(a) status, the number of actions and dollars obligated. The data indicate that during the relevant time period, minority-owned businesses accounted for 8.9 percent of the total dollars obligated.[4] In addition, approximately 51 percent of the dollars obligated to minority-owned firms were attributable to 8(a) firms.

Table 1

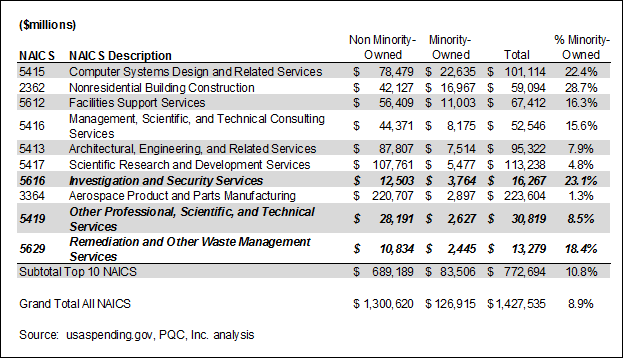

Diving deeper on an industry-level basis, we found significant variation in minority-owned firm activity based on particular NAICS codes. We first investigated the ten NAICS codes that accounted for the most dollars obligated in FY2012 through FY2014. Table 2 presents these data.

Diving deeper on an industry-level basis, we found significant variation in minority-owned firm activity based on particular NAICS codes. We first investigated the ten NAICS codes that accounted for the most dollars obligated in FY2012 through FY2014. Table 2 presents these data.

Table 2

Large differences existed in the level of minority-owned firm participation between different NAICS codes. For example, minority-owned firms accounted for 28.7 percent of total dollars obligated in NAICS 2362 – Nonresidential Building Construction, yet accounted for only 4.8 percent of total dollars obligated in NAICS 5417 – Scientific Research and Development Services. There are a number of reasons which might explain these observed differences, including both the number of minority-owned firms operating within a particular NAICS code, the size of particular awards in an NAICS code, the contracting mechanism (i.e., obligated dollars could be associated with a larger procurement instrument) and a host of potential economic and procurement issues that influence whether a particular firm engaged in federal procurement within an industry. Indeed, disparity studies are often a cornerstone of evaluating existing policies and programs designed to facilitate contracting activity among underrepresented groups.

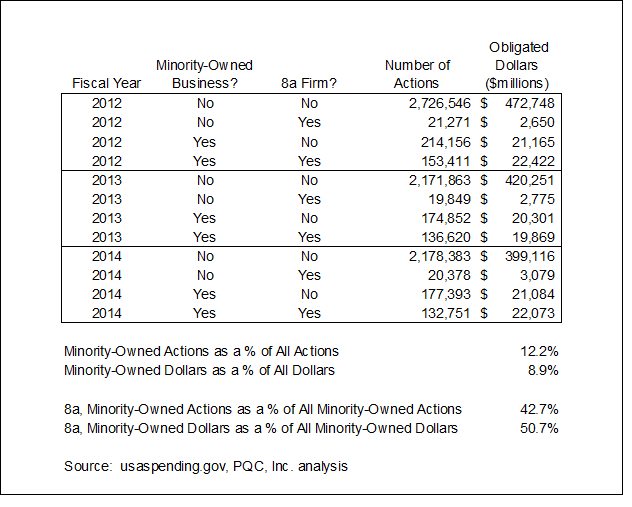

We expand the analysis to focus on the NAICS codes with the largest dollar amount obligated to minority-owned firms. Table 3 summarizes these data, which have significant overlap with Table 2. Exceptions are noted in bold and italics, representing NAICS codes in Table 3 that do not appear in Table 2.

Table 3

The data indicate that for 7 of the top 10 NAICS codes for minority-owned firms, the utilization (as measured in percent of total dollars awarded to minority-owned businesses) exceeds the overall minority-owned business average of 8.9 percent. Exceptions include NAICS 3364 – Aerospace Product and Parts Manufacturing (which is dominated by several large conglomerates), as well as NAICS 5413 – Architectural, Engineering and Related Services (at 7.9 percent) and the aforementioned NAICS 5417 (at 4.8 percent).

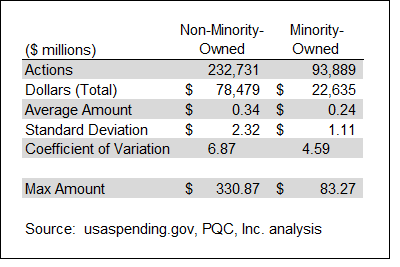

As part of our investigation, we examined the largest NAICS code for minority-owned activity based on dollars (NAICS 5415 – Computer Systems Design and Related Services). Table 4 presents a comparison of key metrics between minority- and non-minority-owned firms in this NAICS code. Interestingly, the average dollar amount per contract action is significantly lower for minority-owned firms ($240,000 versus $340,000), although the coefficient of variation is also lower.[5] One reason for this observation is the presence of several large contract actions. Notably, the maximum amount for a non-minority-owned firm is approximately $331 million, which is almost four times greater than the maximum contract action for a minority-owned firm.

Table 4

In future blog posts, we will continue to share insights into federal procurement activities for minority- and women-owned firms. As always, if you need any assistance with market research regarding contracting activity, disparity study analysis, or federal procurement assistance, do not hesitate to reach out and contact us!

In future blog posts, we will continue to share insights into federal procurement activities for minority- and women-owned firms. As always, if you need any assistance with market research regarding contracting activity, disparity study analysis, or federal procurement assistance, do not hesitate to reach out and contact us!

[1] We used data from usaspending.gov, which captures data from the Federal Procurement Data System – Next Generation (FPDS-NG).

[2] NAICS refers to the North American Industrial Classification System, which categorizes industry-level activity into a series of 6 digit NAICS codes. Primary NAICS categories are captured at the initial 2 digits, with each successive digit providing a greater level of detail and less aggregation.

[3] This flag indicates whether a firm “self-reports” as a minority-owned firm.

[4] To place the 8.9 percent value in context, recent Census data indicate that as of 2012, there were approximately 8.0 million minority-owned firms, up from 5.8 million in 2007. The Census data also indicate the 8.0 million minority-owned firms represent 29 percent of all firms with or without paid employees in 2012. See http://factfinder.census.gov/faces/tableservices/jsf/pages/productview.xhtml?src=bkmk.

[5] The coefficient of variation is the standard deviation divided by the mean. It is a measure of dispersion in a particular distribution. A higher coefficient of variation indicates a higher variation.